Fiscal conservatives are democrats now

Trump's bill costs nearly as much as the Iraq and Afghanistan Wars combined

Trump's bill costs nearly as much as the Iraq and Afghanistan Wars combined

I was raised by fiscal conservatives. They tithed their income to our church. They gave generously to relief organizations active around the world. I thought new clothes came from Walmart. Many of my things were hand-me-downs. I virtually never went to the mall as a child. I thought Gap was a designer brand. My parents' austerities continued into my young adulthood. To help me avoid student loan debt, I don't think they ordered my little brothers a pizza during my undergraduate career. I finished both my bachelor's degree and first master's degree with no debt.

While I personally have come to believe in a more robust investment in priorities, whether at the level of one's individual budget or for the country, I still can hear their advice in my mind, and I consider it when I am making financial decisions. I've been thinking about fiscal conservatives a lot lately, especially as my concern grew over the president's big ugly bill which passed early this morning, promising to grow the country's deficit by an astounding 3.8 trillion USD according to a CBO estimate. The bill does little to solve actual problems faced by Americans, all while making existing problems worse. As has been widely reported, the bill is designed to cut taxes for the already-wealthy at an enormous long-term cost to Americans.

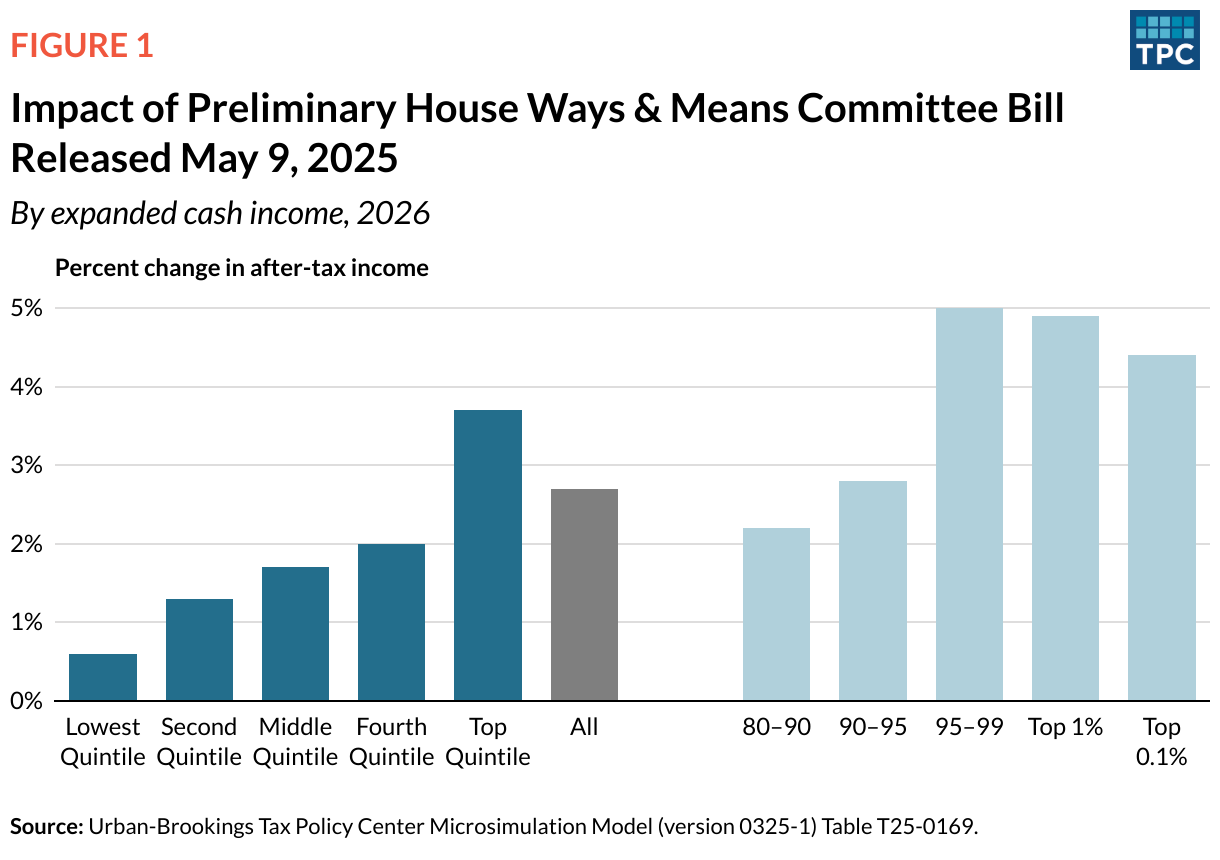

According to the non-partisan Tax Policy center, top earners benefit the most as depicted in this graphic:

A quintile is a fifth of the population. The lowest quintile are those earners who make less than $34,600. The second quintile include those who make less than $66,800, the third quintile are those who make less than $119,200; and the fourth quintile are those that make less than $217,100. The top quintile are those who make $317,700 or more. Broken down more, anyone making more than $1,141,900 is considered in the top one percent, and anyone making more than $5,184,900 is considered the top tenth of one percent of earners in the country.

As you can see, people making over 300K benefit most from the bill, making nearly four percent more under the bill. But even within that top quintile, the benefits are skewed to the most wealthy, the 95-99 percent (that's what the second set of light blue bars indicate), with their after-tax income increasing a full five percent.

Meanwhile, those in the lowest quintile actually suffer a decline in their standard of living, since in addition to the tax cuts given proportionately to the wealthy, many of the benefits poorer Americans currently receive are also slashed by the bill including a reduction in $698 billion for Medicaid and $267 billion in SNAP, a program that feeds the poorest members of our communities.

The CBO estimate put it plainly:

"CBO estimates that household resources would decrease by an amount equal to about 2 percent of income in the lowest decile (tenth) of the income distribution in 2027 and 4 percent in 2033, mainly as a result of losses of in-kind transfers, such as Medicaid and SNAP... By contrast, resources would increase by an amount equal to 4 percent for households in the highest decile in 2027 and 2 percent in 2033, mainly because of reductions in the taxes they owe. The distributional effects vary throughout the 10-year projection period as different components of the legislation are phased in and out."

That's right. We think rich people should have more money and we have dramatically reduced the safety-net that poor Americans currently have in a moment when the President's inept economic policies will dramatically increase prices and increase uncertainty for businesses (who will reduce hiring and investments), and contribute to inflation.

These tax cuts follow a long history of Republicans constructing tax policies that dramatically contribute to the US deficit at the same time that they are structured to make it difficult to evaluate their true costs. Chapter two of the book Off Center by scholars Jacob Hacker and Paul Pierson, political scientists from Yale and UC Berkeley, first brought this to my attention nearly twenty years ago. The chapter detailed how Bush-era tax cuts were structured with small benefits for the middle class initially, but massive tax-cuts for the wealthy later on, and estimates for the true cost of the cuts were consistently, in their words, "blatantly distorted" (p.58).

Look for yourself at the impact of Presidential budgets on the deficit (graphic prepared by data collected by political scientist Gerhard Peters). The American Presidency Project tracks a large amount of data related to presidential administrations. In the chart linked here, the surplus or deficit as a percentage of GDP per year of each presidential administration is reported in the final column. As you can see, Democrats consistently reduce the budget deficit over the course of their terms. It's time to admit that Democrats are the true fiscal conservatives even with a commitment to social spending.

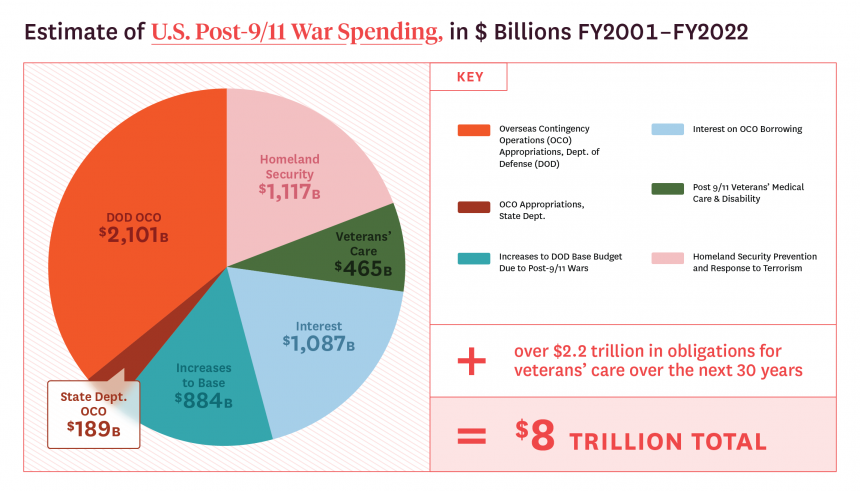

It can be difficult to understand the scope of these numbers, but I have found an effective way to evaluate them. By coincidence, I have been preparing a new class for the fall semester, in which I am reading a certain amount about the US wars in Iraq and Afghanistan. Depending on how you measure the costs of these wars, the Trump tax cuts cost nearly as much as counterterrorism operations in Iraq, Afghanistan and elsewhere since 2001 if you exclude the costs of care for veterans.

As you can see, the direct cost of military operations (the DOD category), is estimated at approximately 2.1 trillion USD, and 1.1 trillion USD spent through Homeland Security. If we include the interest on the debt that was floated to pay for these wars, the cost of the wars is estimated at a little over 4 trillion USD, prior to including the costs of increasing the capacity of US bases and care for veterans.

This bill is a real chance for Americans to reflect on their priorities and whether or not they are taken into account in this spending bill. And if you favor a reduction in the deficit, as I know many voters do, it's probably time to become a Democrat.